Last Updated on December 5, 2025

FreshBooks is a cloud accounting software that has been perfected for freelancers and small businesses.

If you want simplicity and efficiency in your bookkeeping, this is one of the tools for you.

Its strong time-tracking and invoicing features makes it one of the top players in cloud accounting.

However, it has its own shortcomings and to learn more, keep reading and see if it’s the right software for you.

In this detailed FreshBooks review, I dive deep to show you why you may consider using it.

| Attribute | Score |

|---|---|

| Ease of Use | |

| Customer Support | |

| Integrations | |

| Features | |

| OVERALL RATING |

Pros

- User-friendly, even for non-accountants

- Excellent invoicing and time-tracking

- Built mainly for freelancers and service-based businesses

- Clean, intuitive user interface

- Excellent, fast customer support

Cons

- Limited reporting features

- Costs rise when you add more team members

- No built-in payroll feature

- Not ideal for product-based businesses

Jump To Section:

Company background

FreshBooks was formed by a Canadian entreprenuer, Mike McDerment, in 2003, evolving from an invoicing company for freelancers and small businesses to a fully-fledged cloud accounting powerhouse.

Realizing that some of the users do not have a strong accounting background, FreshBooks simplified their platform without sacrificing functionality.

Over the years they continued to add features to cater for the ever-changing needs of users.

FreshBooks carved a niche to provide an all-in-one easy solution for freelancers and small businesses.

What makes FreshBooks unique

1. Beginner-friendly

FreshBooks is designed with non-accountants in mind.

From my testing, I didn’t need to wrestle with technical jargon or complex accounting features just to get started.

The onboarding process is smooth as you can activate the free trial and sign up with your Apple or Google account without entering credit card details.

This shows that FreshBooks is confident enough in its product to let you explore before committing, something beginners especially appreciate.

2. Simple dashboard

Once inside, you’re welcomed by a clean, intuitive dashboard where all essential tools are neatly placed on the left-hand panel.

Even if you’re new to accounting software, the layout makes it easy to navigate.

In my experience, when I had questions, FreshBooks’ support team was responsive and knowledgeable, giving me confidence that I wouldn’t be left stuck.

3. Built-in time tracking and invoicing

Freelancers and service-based businesses often struggle with billing clients accurately. FreshBooks solves this by combining invoicing and time tracking in one place.

You can create professional invoices with embedded payment links, making it simple for clients to pay you faster.

The time tracking feature is equally valuable:

- Bill clients accurately based on hours worked

- Boost team productivity and accountability

- Improve project estimates by analyzing past data

- Streamline payroll and invoicing

I’ve tested this feature, and it really improves transparency with clients—something that builds trust over time.

4. Clean user interface

Unlike some accounting tools that feel like they were designed only for accountants, FreshBooks keeps the interface minimal and approachable.

Menus and features aren’t buried in clutter, which speeds up everyday tasks.

This design choice reflects FreshBooks’ commitment to serving freelancers, entrepreneurs, and small teams rather than just financial professionals.

5. Excellent customer support

Good support is often overlooked until you need it.

FreshBooks offers 24/7 support through phone, email, and live chat.

While no service is perfect, there are isolated complaints, the majority of users (myself included) have had positive interactions.

The support staff take the time to troubleshoot, rather than sending canned responses, which builds trust in the platform.

6. Excellent automation

FreshBooks’ automation features act like a virtual assistant for your finances. Repetitive tasks such as sending invoices, tracking expenses, and following up on payments are handled automatically.

Key benefits I noticed include:

- Fewer manual errors

- More consistent cash flow

- Less admin stress, more focus on core business

For small business owners, this automation translates directly into saved time and money.

7. Easy-to-use mobile app

FreshBooks’ mobile app (available for iOS and Android) is a strong extension of the desktop platform.

It’s reliable, secure, and fully synced, so you can manage your finances anywhere.

- From my testing, I was able to:

- Create and send invoices on the go

- Track time for client work in real time

- Snap and upload receipts instantly

- Receive real-time notifications

This mobile-first approach ensures you’re always connected, whether you’re a freelancer, small business owner, or part of a remote team.

8. Allows client collaboration

FreshBooks strengthens client relationships with built-in collaboration tools.

Clients can view invoices, approve projects, and make payments, all within the platform.

This not only simplifies communication but also enhances professionalism by keeping all interactions transparent and centralized.

9. Tailored for service-based businesses

FreshBooks stands out for its focus on service-based businesses.

Whether you’re a solo freelancer or managing a small team, you’ll find tools built around billable time, project management, and expense tracking.

Features such as time-tracked invoices, project-based billing, and integrated reporting make it especially valuable for consultants, designers, agencies, and other service providers.

10. Simple, useful financial reports

Understanding your numbers shouldn’t require an accounting degree.

FreshBooks provides easy-to-generate reports like profit and loss, expense summaries, tax summaries, and accounts aging.

From my experience, these reports not only simplified tax prep but also gave me insights into cash flow and profitability, helping me make smarter business decisions.

11. FreshBooks App Store

To extend functionality, FreshBooks offers an App Store with vetted, high-quality integrations.

These are plug-and-play apps covering payments, CRM, project management, and more.

The fact that FreshBooks curates these apps ensures you’re working with trusted tools that integrate seamlessly, no complex setups required.

Price and value

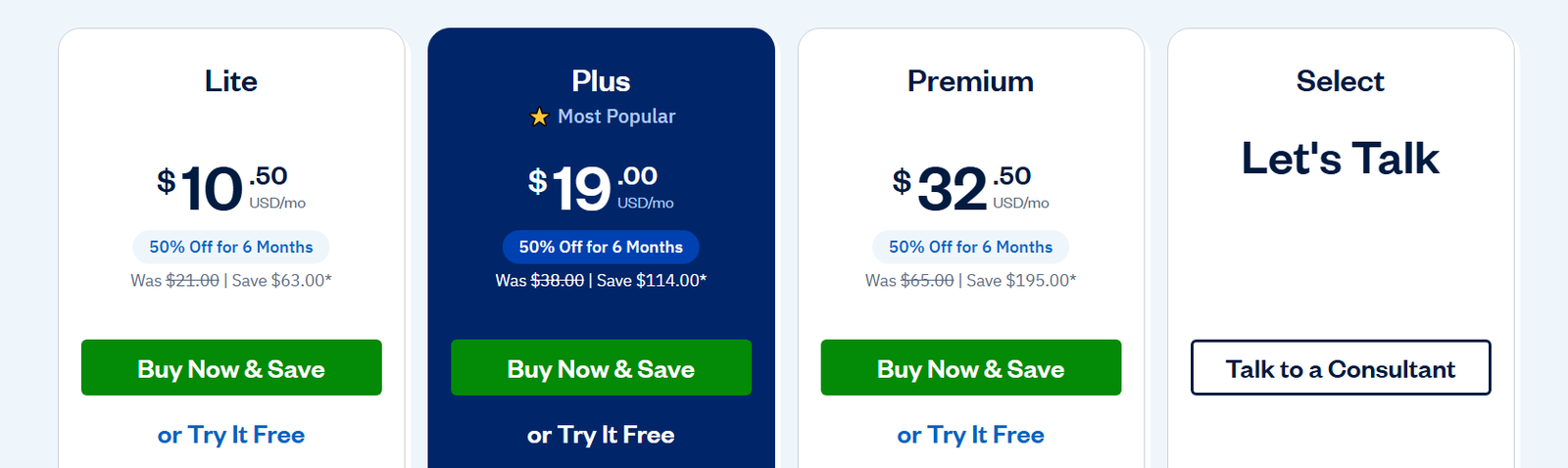

FreshBooks offers four pricing tiers, with the fourth being a customizable Select Plan designed for businesses with unique needs.

While FreshBooks doesn’t provide a free plan (unlike some competitors such as Wave or Zoho Books), the structure is straightforward and scalable as your business grows.

From my own testing, I found that even the entry-level plan packs in enough functionality for freelancers or solopreneurs to get started, while higher tiers unlock automation and advanced reporting for growing teams.

Lite Plan – Best For Solopreneurs

The Lite Plan is a strong entry point if you’re just starting out.

It allows invoicing for up to 5 clients, making it suitable for freelancers who handle a small client base.

Key features include:

- Unlimited invoices

- Expense tracking

- Time tracking

- Online payments

- Estimates

At $10.50/month (50% off for the first 6 months), this plan offers excellent value for beginners, though you may quickly outgrow the client cap if your business expands.

Plus Plan – Best For Growing Businesses

The Plus Plan is where FreshBooks really begins to shine for small but expanding businesses.

You can invoice up to 50 clients and unlock features that help with recurring revenue and financial insights.

Key features include:

- Everything in Lite

- Recurring billing

- Client retainers

- Business health reports

- Automatic late payment reminders

At $19/month (50% off for the first 6 months), this plan balances affordability with tools that save time and improve cash flow management.

Premium Plan – Best For Larger Client Bases

If you’re running an agency or established business managing multiple clients, the Premium Plan removes the limits.

You can invoice unlimited clients and access all available features.

Key features include:

- All Plus Plan features

- Advanced reports

- Team permissions

- Custom email templates

Priced at $32.50/month (50% off for the first 6 months), this plan is tailored for high-volume businesses that need efficiency and scalability.

Select Plan – Best For Tailored Solutions

For businesses with specialized requirements, FreshBooks offers the Select Plan, a customizable option built with input from their sales team.

Key benefits include:

- Dedicated account manager

- Customized onboarding and training

- Reduced credit card transaction fees

- Integration with advanced accounting tools

This plan is ideal for enterprises or companies needing personalized workflows and priority support.

Add-Ons (Available Across All Plans)

FreshBooks also offers optional add-ons that expand functionality:

1. Team members – $11/month per user

- Lets you add extra staff to collaborate.

- Downsides: competitors like Xero allow unlimited users at no additional cost.

2. Advanced payments – $20/month

- Enables advanced online payment methods.

- Saves client payment details for smoother repeat billing.

3. FreshBooks payroll – Starting at $40/month + $6/user

- Automates payroll processing, including state and federal tax submissions.

- Saves time and reduces compliance risks.

What users are saying

To get a balanced perspective, I reviewed user feedback on well-known platforms like Trustpilot, G2, and Capterra.

These sites aggregate reviews from real users, giving insight into how FreshBooks performs in day-to-day business use.

Overall, the sentiment is largely positive, though there are a few recurring drawbacks you should be aware of.

Positive experiences

Users consistently highlight FreshBooks’ strengths in usability and support:

- Very user-friendly – Many small business owners and freelancers praise its simple learning curve compared to accounting-heavy platforms like QuickBooks.

- Excellent customer support – The 24/7 availability and responsive team are frequently mentioned as standout benefits.

- Professional invoicing – Users appreciate the ability to create polished invoices that make their businesses look more credible.

- Time tracking saves hours – Service-based businesses find this feature particularly valuable for accurate billing and project management.

- Mobile app – Highly rated for convenience, allowing users to invoice, track time, and manage expenses on the go.

- Client portal – Streamlines collaboration, giving clients transparency into invoices, payments, and project progress.

- Automation – Reduces manual work and ensures invoices and reminders go out on time, helping improve cash flow.

Common complaints

Not every experience is perfect, and FreshBooks does have some limitations that users frequently mention:

- Not ideal for product-based businesses – Inventory management is limited, so retailers may prefer a solution like QuickBooks or Xero.

- Price increases over time – Some long-term users have noted subscription costs rising.

- Charges for extra team members – At $11 per user per month, costs can add up quickly for larger teams.

- Reporting depth – While reports are easy to generate, some users feel they lack the advanced customization offered by QuickBooks or Xero.

Takeaway:

FreshBooks earns strong marks for ease of use, customer support, and invoicing, areas that matter most to freelancers, solopreneurs, and service-based businesses.

However, if your business is product-heavy or requires deep financial reporting, you may want to compare it against competitors like QuickBooks or Xero before deciding.

Is FreshBooks right for you?

If you’re still undecided, FreshBooks is worth considering if your business matches the following scenarios:

FreshBooks is a good fit if:

- Your business is service-based (consulting, freelancing, agencies, professional services) where billing clients is core.

- You want simple yet professional invoicing software without a steep learning curve.

- You need accurate time tracking for projects or client work.

- You collaborate with clients or work with small teams and need streamlined communication.

- You want automation for recurring invoices, reminders, and payment follow-ups.

- You prefer easy-to-understand reports over complex dashboards.

- You value reliable customer support that’s available when you need it.

FreshBooks may not be ideal if:

- You run a product-based business requiring advanced inventory management.

- You need a built-in payroll system (though FreshBooks integrates with third-party payroll providers, it’s an extra cost).

- You require advanced bookkeeping and reporting tools beyond basic financials.

Bottom line:

From my experience and reviewing user feedback, FreshBooks is best suited for freelancers, solopreneurs, and small to mid-sized service businesses who want intuitive, professional accounting software that doesn’t overwhelm with complexity.

It allows you to focus on your core business and revenue generation, while handling invoicing, time tracking, and cash flow automation in the background.

If, however, you anticipate needing enterprise-level features such as complex reporting, inventory management, or built-in payroll, you may want to explore alternatives like QuickBooks Online or Xero, both of which scale better for larger, more complex operations.

Our final verdict

My take: FreshBooks is a strong choice for freelancers, solopreneurs, and small service-based businesses.

It offers all the essentials, professional invoicing, time tracking, automation, and client collaboration, without overwhelming you with accounting jargon.

These features make it especially effective for building trust and maintaining transparency with clients.

That said, FreshBooks does have limitations.

While it integrates smoothly with third-party payroll providers, it doesn’t include a native payroll system, something QuickBooks Online provides out of the box.

Another drawback is the $11 per user, per month charge for additional team members.

If your team grows beyond a handful of users, costs can escalate quickly.

In these cases, competitors like Xero, which supports unlimited users at no extra cost, may offer better long-term value.

FAQ

Can FreshBooks handle payroll?

There's no built in payroll system but FreshBooks can integrate seamlessly with providers like Gusto if need arises.

How much does it cost to use FreshBooks?

Plans start at $21 per month for the Lite Plan, with 50% OFF for the first 6 months. If you want to add additional users it costs $11 per month for each user.

Can I collaborate with clients on FreshBooks?

Yes, clients have a dedicated portal where it's easy to view invoices, make payments or leave comments on projects.

Is the FreshBooks mobile app reliable?

The app is highly rated for user-friendliness, allowing you to send invoices, track expenses and more, while you're on the move.

What reports can I generate?

FreshBooks allows you to generate these reports:

- Profit and Loss report

- Expense report

- Tax summary

- Time tracking

- Payments collected

Can my team track time individually?

Yes, your team members can track their time on the Plus Plan and above. You can view and approve their hours before billing clients to ensure transparency.

Is FreshBooks customer support helpful

Absolutely. FreshBooks customer support is highly rated and you interact with knowledgeable staff, not bots. It's one of their strongest attributes making it a favourite with small businesses.

How does FreshBooks compare to QuickBooks, Xero or Zoho?

FreshBooks excels for its ease of use, collaboration with clients and time-tracking. QuickBooks and Xero have their strengths in advanced payroll and inventory accounting. Zoho is praised for its low cost and a strong Zoho ecosystem.

Wrapping up

FreshBooks is a good choice if you are a service-based professional and you want a user-friendly accounting solution for your business.

It’s not the best for scalability and you can explore other softwares before making the final decision.

Test out all the features risk-free for 30 days and see if it’s for you.

Comparison:

- FreshBooks vs QuickBooks Online

- FreshBooks vs Xero

- FreshBooks vs Zoho Books

- FreshBooks vs AccountEdge Pro

- FreshBooks vs Patriot Software

- FreshBooks vs OneUp

- FreshBooks vs Wave

- FreshBooks vs Kashoo

- FreshBooks vs Sage

- Best Accounting Software For Restaurants In 2026 - January 5, 2026

- Best Accounting Software For Retail Businesses In 2026 - January 4, 2026

- Best Accounting Software For Property Management - January 4, 2026